New electric vehicle sales have slowed to 4.7 per cent growth in 2024. Have EVs reached the ‘tipping point’ in Australia?

According to official data published by the Federal Chamber of Automotive Industries (FCAI) and Electric Vehicle Council (EVC), 91,292 full electric vehicles have been delivered in Australia in 2024 – up 4075 units compared to 2023.

For context, that’s small growth when new EV sales increased by a substantial 53,807 units (up 161.1 per cent) in 2023 year-on-year.

Courtesy of data compiled by Drive, the Tesla Model Y, Model 3 and MG 4 topped the new electric car sales charts in Australia in 2024.

However, despite the return of sharp discounts not seen since the COVID-19 pandemic and aggressive price cuts of some EV models to curb an oversupply, overall new car sales went on a downward trend in the later half of the year. Let’s explain…

UPDATE 12/1/25: In response to reader feedback, the story has been updated to clarify the EV slowdown is on demand, rather than total deliveries.

We’ve reached ‘the chasm’.

It’s understood the early adopters who wanted an EV have already bought one and we’re now waiting for mainstream consumers.

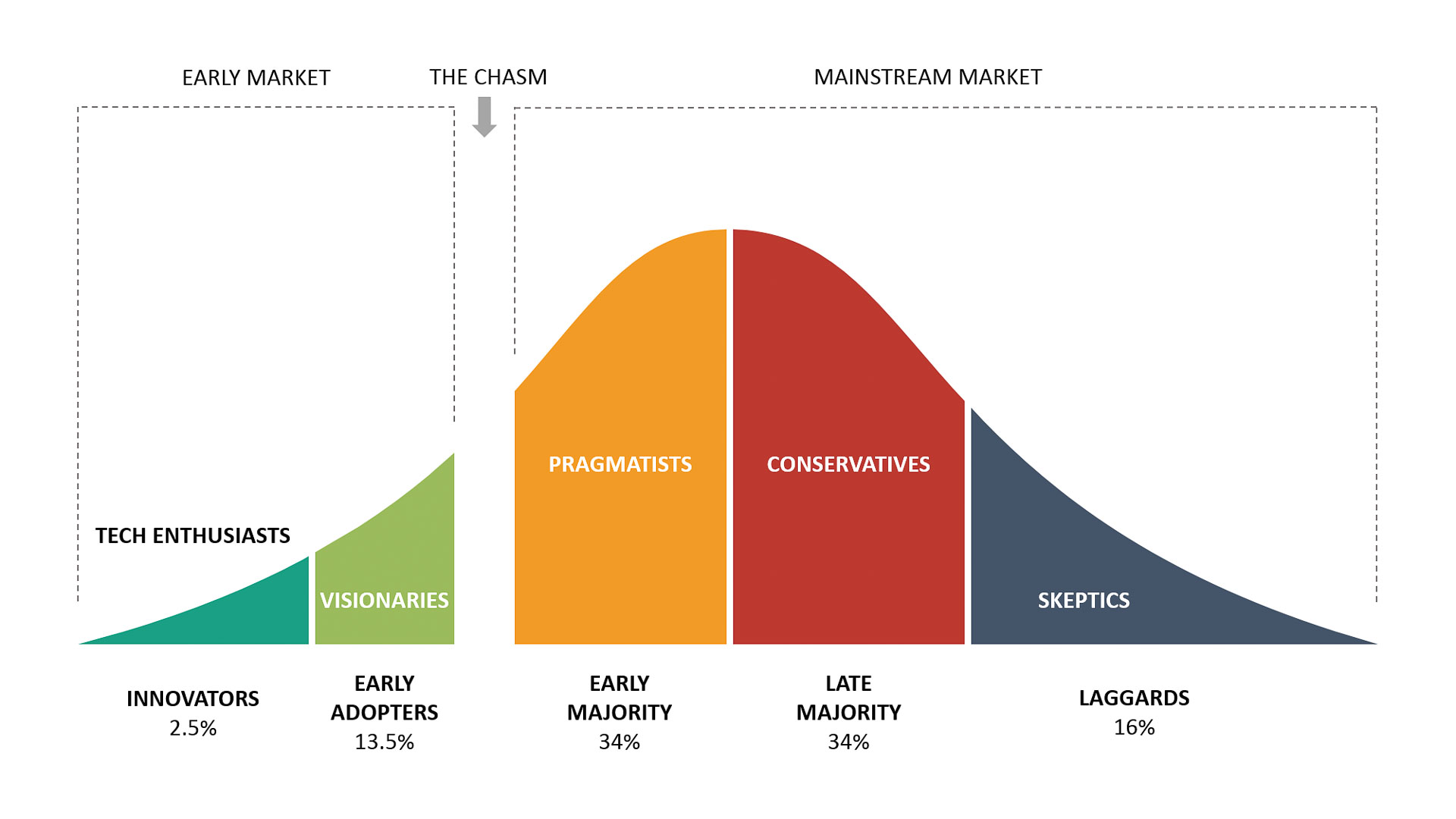

According to Moore’s technology adoption curve (adapted from Rogers’ original 1962 theory), there is a disruption called ‘the chasm’ where the mainstream market hasn’t yet accepted the new tech, but the innovators and early adopters have already taken it up.

Therefore, as echoed by Kia Australia’s chief Damien Meredith, ‘the chasm’ reflects the current stage of the EV market in Australia, amid a slowdown in new EV sales demand in 2024.

It’s important to note the electric car market downturn was largely driven by significantly fewer Tesla sales (down 16.9 per cent) – the worst-performing car brand last year compared to 2023, courtesy of number-crunching by CarExpert.

It’s not helped by the end of EV rebates in the most populated Australian states, and aggressive price cutting by some brands exacerbating depreciation for owners (and hesitation for buyers).

Fear, hesitancy and misinformation also continue to surround electric cars, particularly around battery longevity, safety, charging, and driving range.

Cost-of-living.

Overall new vehicle sales were only up 1.7 per cent in 2024, in a sign of cost-of-living pressures biting.

Yet, the fact that electric vehicles were still in the green (up 4.7 per cent) means it still outpaced overall new-car market growth.

Despite an upwards trend in new car sales in the first half of 2024 and the return of manufacturer discounts not seen since the pandemic, deliveries took a significant downturn in the second half of the year.

All up, more than 1.23 million new cars were registered in Australia last year – which is still higher than pre-pandemic levels.

While EVs have felt the sales slowdown the most, it has not tanked.

New pure petrol and diesel vehicles have experienced 10.1 and 2.5 per cent fewer sales respectively compared to 2023 as motorists shifted more towards hybrids.

Stagnantly high interest rates on personal (car) and home loans have also likely contributed to waning demand, particularly for private buyers.

Hybrid hype.

Greater choice and supply has seen a significant rise in hybrid car popularity.

According to the FCAI, 172,696 traditional hybrid cars and 23,163 plug-in hybrid electric vehicles (PHEVs) have been registered in 2024 – up 76.0 and 100.2 per cent respectively.

Hybrid cars have represented an excellent stepping stone to full EVs.

Traditional hybrid models generally carry a small price premium – offering easy accessibility for drivers looking to save on fuel costs and have a taste of electrification, without making the mental leap to think about charging and range.

Meanwhile, PHEVs offer full electric driving for short distances and the backup of a familiar combustion engine – while novated lessors can still benefit from the fringe benefits tax (FBT) exemption until 31 March 2025.

The supply of hybrids has also been accelerated by the federal government’s New Vehicle Efficiency Standard (NVES) – which enforces an emissions cap on each carmaker’s overall sales.

Toyota has now gone hybrid-only for most models, supply has been substantially boosted for Hyundai and Kia hybrids, and there are even plug-in hybrid pickup trucks including the BYD Shark 6 and Ford Ranger PHEV.

Australians now have a diverse choice of hybrid models ranging from Toyota to GWM and Nissan in the form of small cars to SUVs and utes.

Have we reached the ‘tipping point’ of EVs?

New electric vehicle sales demand has slowed down in Australia, but it’s still in the green and doesn’t necessarily spell the end of its future.

There are always hurdles to new technologies and dips in demand are inevitable in the adoption curve; there won’t always be linear growth every month or year for every brand or model. It will take time.

The silver lining of this slowdown? In 2025, the choice of EV models will further grow and be even more price competitive, as the market matures and consumers overcome their fears, alongside the used EV market.

We’re already seeing this with the release of the BYD Dolphin Essential. Priced from $29,990 before on-road costs, the base model small electric hatchback is cheaper than a base Toyota Corolla Hybrid, Mazda 3 and Hyundai i30 – and in line par with the Toyota Yaris Hybrid, Volkswagen Polo and Kia Cerato.

However, the market has spoken: a mix of powertrains are needed in the EV transition.

Australians have embraced hybrids and plug-in hybrids – and car brands are responding in order to profitably sell cars and meet increasingly strict emissions regulations.

Until the mainstream accepts EVs, fuel-efficient and lower-emission hybrids have become the go-to alternative powertrain choice.

READ MORE: 2024 Cupra Born review

READ MORE: What is the point of the blue EV label?

READ MORE: Living with the 2024 Nissan Qashqai Ti e-Power

About the Author.

Henry Man is an independent content producer passionate about the intersection of technology and transportation.

The former automotive journalist is focused on producing critically-detailed vehicle reviews, and unique short-form content. Learn more.